Featured in this post

The Ultimate Profit Strategy Guide for Consumer Goods Businesses

The Ultimate Profit Strategy Guide for Consumer Goods Businesses

Jul 21, 2020

Aptean Staff Writer

Aptean Staff Writer

Good business leaders are always searching.

Searching for ways to improve operations. For ways to improve team continuity and company culture. For ways to innovate. For ways to become more profitable. For ways to cement success.

Because, let’s face it, success is hard work. It relies on so many essential parts.

And in terms of profitability, without robust tools to monitor and analyze your financials, it’s going to be tough to stay in the black. Integrated systems and tools can help you automate and analyze profitability at the customer, product and supplier level.

A general ledger gives chief financial officers (CFOs) a simplified view of profit-eroding costs and expenses. But that view only tells part of the story. The rest of the story comes from a richer perspective, one that details which customers, products and suppliers are responsible for those costs and expenses. Understanding the impact of below-the-line expenses, like negotiated and non-compliance-related chargebacks, gives CFOs the answers they need to determine whether retailer relationships, individual brands or suppliers are contributing to —or eroding — company profitability. Take customer freight charges. There are standard, garden-variety freight costs, negotiated allowances on freight, and rush freight charges that resound on the income statement. Because root causes for those charges aren’t identified or clarified, profit from the sale won’t accurately be reflected in customer, product, supplier and sales rep profitability calculations. This means CFOs don’t have an accurate measure of how cost outliers impact these profitability views. It’s also a challenge to understand the true net profitability of your biggest customers. Standard accounting practices that look at gross margin calculations alone don’t consider royalties, commissions, chargebacks, exclusive deals, duty and insurance. But leading-edge profitability tools that can allocate cost outliers do exist. Best-in-class consumer goods companies are implementing best-practice enterprise resource planning (ERP) solutions that are fully integrated and industry-specific. These software solutions feature cascading data that automatically populates into profitability matrices, so CFOs can quickly and accurately calculate true net profit with a few simple keystrokes.

Gross Margin Calculations Aren’t Enough

There are a lot of software options out there. A lot of solutions that promise to deliver good enough results on landed costs by customer and by product. And that’s good. Calculating the landed cost of your brands is a valuable first step. But let’s think about this. Are calculations that only measure purchase price, duty, freight, brokerage and insurance fees good enough? Is good enough really good enough? Best-in-class consumer goods companies, instead, use integrated net margin tools that dive deeper to calculate below-the-line consumer goods profitability—the real net profit results—by customer, product or supplier. Understanding the impact of commissions, royalties, cash discounts, freight adjustments, chargebacks, sales salaries and exclusive deals can alter a company’s view of its profitability landscape. To highlight areas of success or to reveal the land mines just below the surface endangering profit margins.

Integrated Solutions Drive Operational Excellence

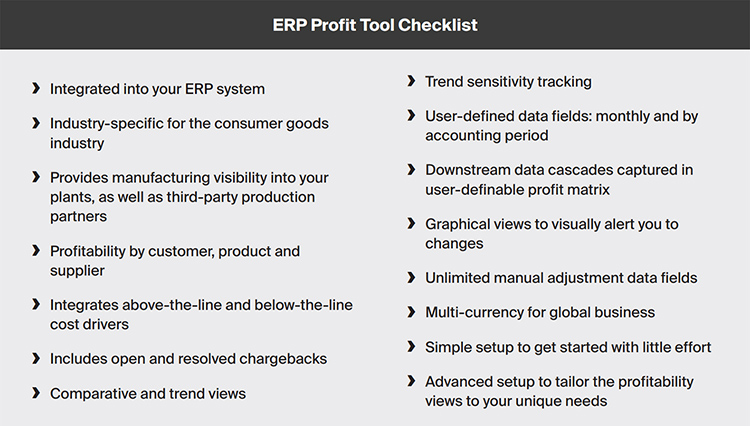

An ERP solution that is fully integrated into your business operations and leverages user-defined data fields and workflows delivers fast, accurate and reliable results.

Because all of your data lives in a single place, accessing it is simpler, and more importantly, it means everyone is working off of the same information. There’s no more decision making from the rear-view mirror, and there’s no more room for data misalignment between departments.

Integrated profitability solutions also allow you to drill into the detail level of all your cost drivers, so you can see the impact that individual costs are having on your business. Choosing an integrated profitability solution means fewer piles of paper on your desk, less manual administrative tasks and, consequently, less human error and fewer iterations of the same Excel spreadsheet. It means more time for you. To lead your employees. To cultivate your business. To grow your profitability.

An investment in an ERP that includes integrated profitability tools is smart business—is profitable business.

From these automated profit tools, you get:

Dependable analytics and insight into real net bottom-line profitability

Instantaneous, real-time information

Improved data sharing and visibility throughout the organization

Improved response times and decision making on processes, products and relationships that erode profit margins

User-friendly tools that make it easy to share reporting in multiple formats to meet stakeholder needs and requirements

Total Visibility into Your True Profitability

It’s simple. You can’t correct areas of the company that are underperforming without complete insight into profitability.

The ability to access comparative results based on individual stores, chains and products are critical when analyzing a company’s true bottom-line results. Knowing how individual suppliers, products, and trading partners measure over time and up against each other provides a company with valuable intelligence that can be used to identify problems and opportunities and set future strategies.

It’s invaluable that you not only know but understand industry-specific cost factors—chargebacks, fuel surcharges and allowances—that are hurting your profitability. If your software doesn’t include these variables at a customer, product or supplier level, then you can’t see a complete and holistic view of your profitability picture.

Powerful Results with a Powerful ERP

An ERP equipped with profitability software considers all your cost drivers. Everything from manufacturing processes to order delivery. An integrated system that captures and tracks all this data serves as a powerful tool to better understand and correct recurring procedural errors costing your organization money.

An integrated consumer goods ERP can do it all.

And in terms of profit analysis, it offers:

User-defined data fields and views – CFOs can customize views to make it easy for financial teams to see profitability the way they want to see it. User-defined fields that automatically populate above-the-line and below-the-line cost drivers provide an accurate profitability snapshot by month or period. And tools that incorporate month-end or period-based manual adjustments give you an easy way to edit and adjust cost drivers that occur less frequently.

Profitability calculator – Calculating profitability is a tricky business. Because it’s not one size fits all. It changes based on what you’re trying to measure—whether customers, products, or suppliers.

A chargeback from Walmart, for example, for failing to meet a labeling requirement impacts customer profitability but not product or supplier profitability. With the right tools, the layers of products, costs and partners can be ordered in easy-to-understand matrices that provide the summary and detailed answers you need to understand your business better. Profitability tools that enable you to isolate and calculate cost drivers by customer, product and supplier will give you the most intimate view of your business. You can analyze profitability categories on a broad or granular level for more in-depth business insight with the right profit tools.

Comparative trend views – Rooting out profit wasters from the hundreds of activities, processes and partners can be an overwhelming task. Profit tools that display comparative and trend views, as well as trend sensitives, can help.

Best-in-class companies use comparative views to contrast the bottom line profit results of each of their mass merchant retail partners, compare store-by-store margin returns, department-by-department results and the performance of similar and dissimilar product categories and brands. Trend view takes the analysis one step further by comparing results over user-defined periods. Automated profit tools give you shorter cycle times to get to your real net bottom line so that you can make faster decisions. While actual, historical cost metrics paint a fuller picture that enables you to improve your decision-making.

Profit snapshots – A profitability snapshot is easy with the right ERP. You can easily highlight positive and negative data trends that rise above or fall below user-defined thresholds, making it easier to see and respond to positive and negative data trends.

Setting flexibility – Consumer goods companies often track costs, taxes and revenue in various currencies and languages, and for these businesses, multi-lingual and multi-currency solutions are a must.

Conclusion

Squeezing the most significant profits out of your consumer goods business requires organization, insight and discipline. The first step in understanding your enterprise’s financial health is to gain visibility throughout your supply chain.

An ERP that gives you complete visibility into your business activities, no matter where they occur, can provide you the depth and detail you need to assess all your processes and business relationships.

Our purpose-built distribution ERP, Aptean Distribution ERP, is an all-in-one system designed to handle everything consumer goods importers and distributors need to run and grow their business. To position yourself for financial success, closely monitor your profitability and bring simplicity to the bottom line.

Ready to learn more? Reach out, now.

Ready to Start Transforming Your Business?

We’ve got the specialized ERP solutions you need to conquer your industry challenges.